My favorite book to give as a gift is Rich Dad, Poor Dad by Robert Kiyosaki.

In it, he documents how his early childhood was split between time with his own well-educated father and his best friend’s business-oriented father.

The crux of his book centers around the idea of escaping the rat race – going into educational debt and having a single job – by instead building a business that allows you the freedom to pursue your life.

In his case, real estate was the means. He outlines a few techniques he used and goes further to educate about it other books, course, seminars, and trainings I’m sure.

I have not read those books, bought those courses, attended those seminars, nor paid for training; but the idea stuck.

Real estate.

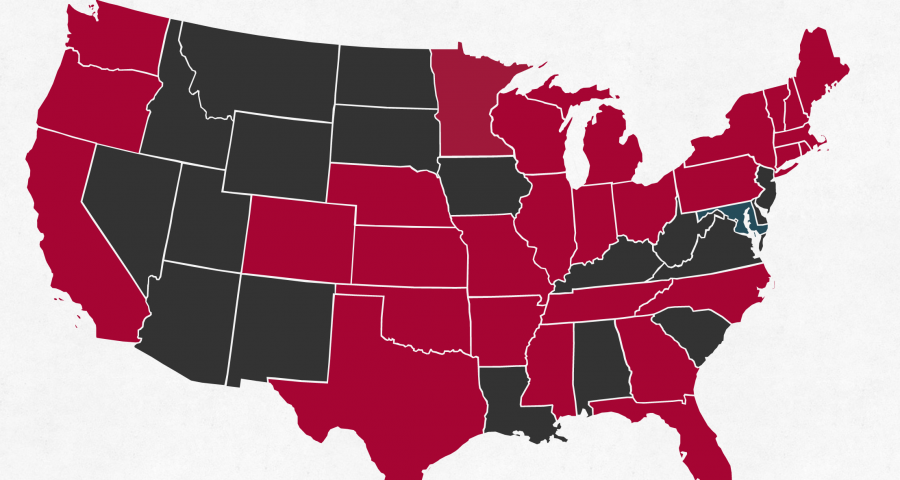

I dove deep into it: reading articles, scrolling through forums, downloading ebooks, listening to audiobooks, attending webinars, buying books, filtering listings, checking crime maps, and even paying to join my local real estate investing (REI) group.

I absolutely loved it. I’d long lived in the tech bubble of virtual passive income and this was my first real consideration and analysis of a physical market. I could actually touch my investment and work with my own two hands to improve it.

It all made perfect sense to me.

Naturally, there are a thousand different ways to pursue it.

Buy. Rehab. Flip. Hold. Wholesale. Lease. Sell. Rent. Sublease. Services. Etc.

Through learning about them all, I found that the simple buy-hold-rent approach fit me the best. Not only was it simple and uncomplicated, but it provided long-term equity and stable income where methods like flipping or wholesaling did not.

I went on to begin looking at properties on Redfin, Zillow, and Trulia. Shortly thereafter, I became inundated with organizing calculations.

First, it started with just plugging numbers into a calculator. It was easy to lose track of my place and I had to restart if I wanted to tweak assumptions.

Then, I tried to use Google Sheets. Though I’m a big fan of the technology and color coding, it just left something to be desired as my properties kept piling up as tabs or as rows.

Finally, I looked into using Bigger Pockets calculator. It allowed me to follow easy steps to fill out my assumptions and I could easily change my answers, but I wasn’t at a place I could justify purchasing the subscription needed to actually use the product on multiple properties.

Instead of purchasing a subscription, I did what any product developer would do: I made my own.

The DIY Real Estate Evaluation Machine

In just over a weekend, I built out my own calculator to aid in my research. I called it Real Estate Evaluation Machine (REEM) and published it as wiserdollars.com.

Where Bigger Pockets’ created a calculator that allows you to run a single property’s evaluation, I build a platform that allows you to add unlimited evaluations to a property.

For example:

Say you find a triplex up town a few blocks from the train stop.

You think: “Ok, I could get traditional financing, put 20% down, and rent all three units at x dollars per month.”

But then your wife asks you to consider moving into one of the units.

And then you think about putting 30% down or pursuing hard money to cover the down payment.

You wonder if you could flip it or even rent the units on AirBNB.

The Solution

With REEM, you can attach each of these scenarios to that property and easily view how they compare to one another.

You can see that the 3-rental scenario actually provides a lower rental income compared to listing on AirBNB. To your surprise, the hard-money loan only makes sense if you flip in 2 months, but can actually provide more net revenue than buy-and-hold.

Though it’s not perfect, REEM provides me the ability to see if a property is truly worth doing the math on. And the best part of it all: I can add new features as I see fit.

So go check it out and let me know how I can improve it!

Specs:

Laravel 5 (PHP) deployed on Digital Ocean

Things I’m proud of:

- Giving the user the ability to create unlimited editable properties with unlimited editable evaluations.

- Using a three-column meta table to house every variable of an evaluation instead of creating dozens of null columns in the evaluation table.

- Deleting a property or evaluation deletes the associated data recursively.

Potential:

- Subscription or pay-per-use monetization

- Multiple evaluation types: AirBNB, Flip, etc.

- Generated graphs of profitability over time

- Additional calculators

Though I’m still building out the product, the fully functional public beta is published and waiting for your use – absolutely free (for now).

If you’re interested in the project, feel free to comment below or contact me to get involved.