My friend recently sent me an email with a bunch of questions about crypto, web3, and the rest.

With their permission, I’ve opted to publish the answers here in the hopes that I could inform more people of my personal opinions.

This is not financial advice, please do your own research before yeeting cash into Web3.

Questions

I have been working a bit on educating myself about crypto and metaverses and I’d love to hear your thoughts and opinions on a few things…

What do you think is the best decentralized asset investment right now? Ethereum? Other cryptos? LAND in Decentraland? Land in other metaverses? NFTs?

First, I don’t know anything about Metaverse platforms or their tokens. Mostly, I find them clunky, unappealing, and not really solving a meaningful problem. I also don’t spend my time trying too hard to better inform this opinion, so take this for what its worth as well.

My personal investing strategy is to follow along with the Fat Protocol Thesis. The thesis states that the value that is being built on top of Ethereum (DeFi, NFTs, L2s, etc) will drive value to the Ether token (ETH) since you need it to participate.

Additionally, the upcoming protocol merge to Proof of Stake expects that the issuance of ETH will decrease 90% (and abate power consumption by 99%). These effects are compelling macroeconomic shifts that should drive the price of ETH up as well, in my opinion.

So, I simply rely on a small recurring buy for ETH that I don’t touch (aka Dollar Cost Averaging – DCA). That’s it.

Alternatively, index-style tokens like BED, DPI, and GMI allow participants to invest in the broad spectrum of Ethereum tokens without picking individual tokens. If you don’t spend the time researching and understanding the individual token, don’t bet on it.

Knowing my technical abilities and limitations from working with me, do you think it’s plausible for me to learn how to use Unity Editor and/or Unreal Engine to make my own NFTs and sell them (on OpenSea or something like that)? Or am I misunderstanding NFTs?

Again, I’m not an expert in NFTs, but: unless you are going to make it a daily career change to learn Unity or Unreal (which are mostly gaming platforms), I don’t recommend this.

In fact, I probably don’t recommend getting into NFT-creation in general. It is an extremely difficult niche to break and is mostly a community building game.

Unless you are quite serious about creating NFTs and building a personal community for you or a DAO-brand, don’t.

The exception might be to provide a graphic design (via Photoshop or Blender3D) and publication service to customers who want to create NFTs.

What basics should I know before getting involved in places like Decentraland or The Sandbox or Somnium Space?

Virtual land speculation is beyond me. As stated above, Virtual Reality platforms don’t really appeal to me. The best use case I’ve seen for them is in creating virtual NFT museums.

Is it best to stay anonymous in these metaverses? I see a lot of usernames that look like much more complex passwords than they look like “johnsmith”.

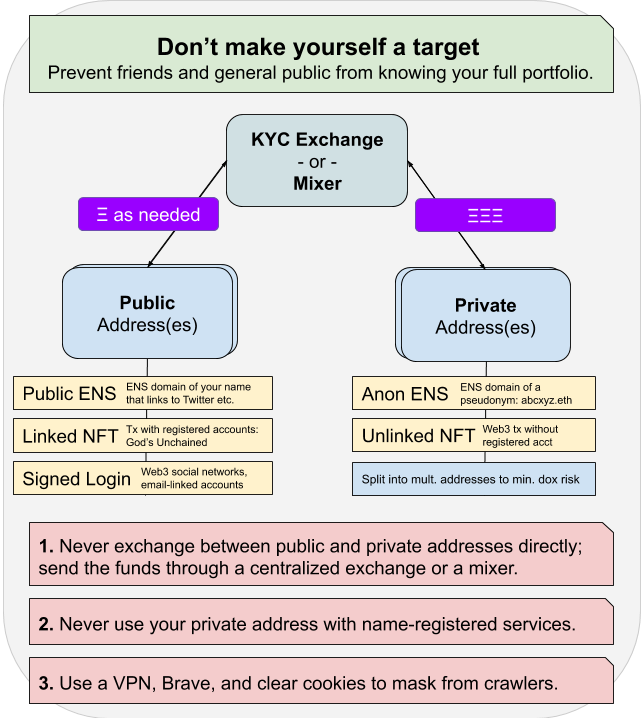

I argue that you should have both a public and private presence in crypto.

That said, yes many people choose anonymous (anon) usernames and NFT profile pictures (pfp’s) as a layer of protection and personal expression.

It depends also if you want to levy your name as a personal brand that can operate between Web3 and IRL, but could potentially be a physical security risk. I choose this path, though at times I wish I had chosen to build an anonymous identity.

What crypto wallets do you recommend? I’m looking at Trezor or Ledger for a hard wallet, and probably MetaMask for an online wallet. Do you prefer others?

I personally use a Ledger Nano S, which is fine. I’ve heard Trezor is just as well. Mostly it’s important to have some kind of cold storage / hardware wallet to protect your funds.

You would then likely also use MetaMask to interface with Web3 applications with your hardware wallet. I often will plug in my Ledger and MetaMask allows me to connect it to the websites I frequent.

I also have a small amount of crypto within MetaMask to participate with things on-the-fly, but always treat this as assets I could have stolen.

What should I expect to pay in fees for wallet transfers and crypto transactions?

For normal transfers, $5-15. For NFT and DeFi transactions, $50+. These are rough estimates for operating on Layer 1 (Ethereum Mainnet). Yes, it’s not hospitable for a lot of people, but there are solutions.

The reality is that Layer 1 is not going to be hospitable for retail users in the long run; that’s Plan A. Retail users will (and do) need to move to Layer 2 networks that use Layer 1 to secure their transactions, but ultimately reduce fees by a lot.

So, you might choose to use zkSync L2 (again, this network is built on top of Ethereum Layer 1) and transfers would be $0.01 etc. You would always have the option to move your funds back to mainnet, though.

What technology do you think I need if I’m going to get involved in this universe? Obviously a VR headset, but which one? And do I need more computing power than just a 2019 MacBook Pro?

I’m not sure VR is a must-have. I don’t really plan on getting a VR headset to participate in crypto, but maybe gaming in general. Maybe some platforms look better in VR, but again I don’t think they look that good to begin with so. 🙂

If you were going to deep dive into 3D rendering, you might need a better rig, but I think there are solutions for that like render farms. Otherwise, you’ll just be joining me in doing fine using DeFi, OpenSea, Discord, and most of Web3 on a laptop.

Got a question? Drop me a line!